Stop the Price Gouging

Stop the Price Gouging!

Oil companies raised gasoline prices in retaliation to California passing bold new climate legislation.

Immediately following the passage of SB 1137 to prohibit new oil drilling near homes, schools and hospitals, big polluters like Chevron, Valero, Phillips 66, PBF Energy, and Marathon Petroleum raised gasoline prices to record levels.

Oil companies are ripping off Californians.

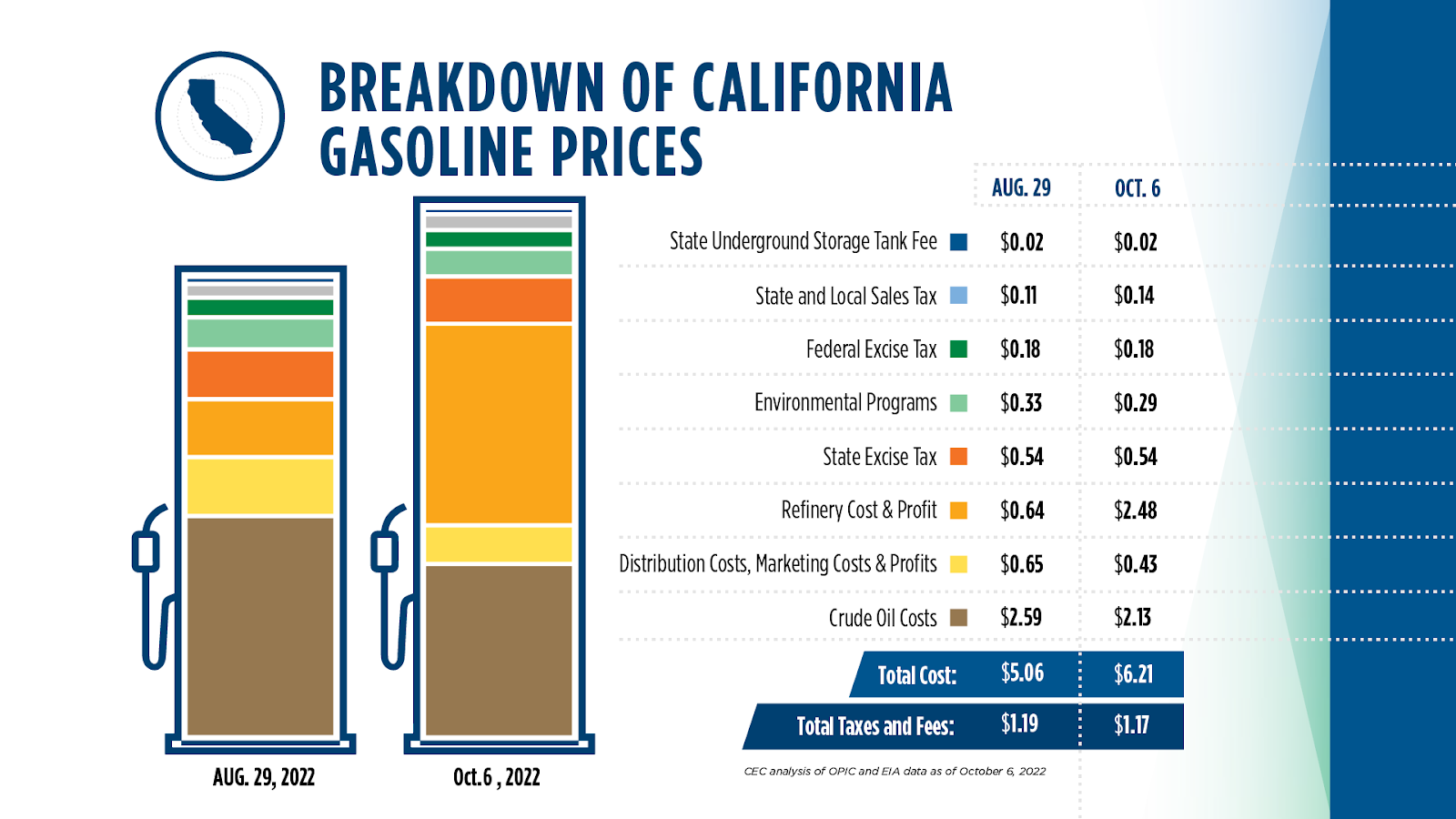

Californians started paying more than $2.60 more per gallon for gasoline than anywhere in the country. This price spike occurred while crude oil prices dropped, state taxes and fees remained unchanged. These skyrocketing prices went straight to the oil industry’s bottom line.

The Western States Petroleum Association, representing all major refiners and oil companies in California, immediately blamed SB1137, the new drilling health protections bill, for the rising gas prices — even though the bill wouldn’t take effect for months or years.

The truth is, oil companies in California operate like a cartel and can set their own prices on gasoline. Five oil companies control 97% of the gasoline pumped in California, which they have used to make billions in record profits while Californians struggle to fill their gas tanks and pay their bills.

California oil refiners have typically made 32 cents per gallon in profits over the last 20 years, but this year they are making over $1 per gallon in profits—a 200% increase in profits.

This spike in gasoline prices resulted in record refiner profits of $63 billion in just 90 days, disproportionately affecting low- and middle-income families.

In the third quarter of 2022, from July to September, oil companies reported record high profits:

- Phillips 66 profits jumped to $5.4 billion, a 1243% increase over last year’s $402 million;

- BP posted $8.2 billion in profits, its second-highest on record, with $2.5 billion going toward share buybacks that benefit Wall Street investors;

- Marathon Petroleum profits rose to $4.48 billion, a 545% increase over last year’s $694 million;

- Valero’s $2.82 billion in profits that were 500% higher than the year before;

- PBF Energy’s $1.06 billion that was 1700% higher than the year before;

- Chevron reported $11.2 billion in profits, their second-highest quarterly profit ever.

A price gouging penalty — or windfall profits cap — is sorely needed to protect Californians from greedy polluters.

Governor Newsom and the California Energy Commission are proposing a new law that would protect consumers from the greedy motives of polluting oil companies.

California already imposes a cap on profits for other energy commodities, like electricity and natural gas. We can and should do this for gasoline prices to protect consumers while ensuring reliable supplies. For example, California regulators have determined that utilities can make a 10% profit off California ratepayers while ensuring they provide reliable energy in the form of natural gas supplies and electricity generation.

Under this type of market regulation, oil refineries can still make profits but within reason so it doesn’t hurt consumers, especially low income and communities of color. Oil refineries will be limited in how much profit they can make to ensure Californians are protected from abnormally high gasoline prices.

How it would work in theory.

The windfall profit cap could cap profits to $0.50/gal and return excess profits to drivers in the form of rebates. Right now, the legislature is debating what amount to set the profit cap to.

Nonpartisan, independent economic studies report that California’s environmental rules and taxes add 69 cents per gallon, but oil companies’ refineries are adding $2.50 per gallon – inflating the cost of gas and leading to unprecedented profits for the fossil fuel industry.

Governor Newsom and the California legislature must hold Big Oil accountable and pass a price gouging penalty.